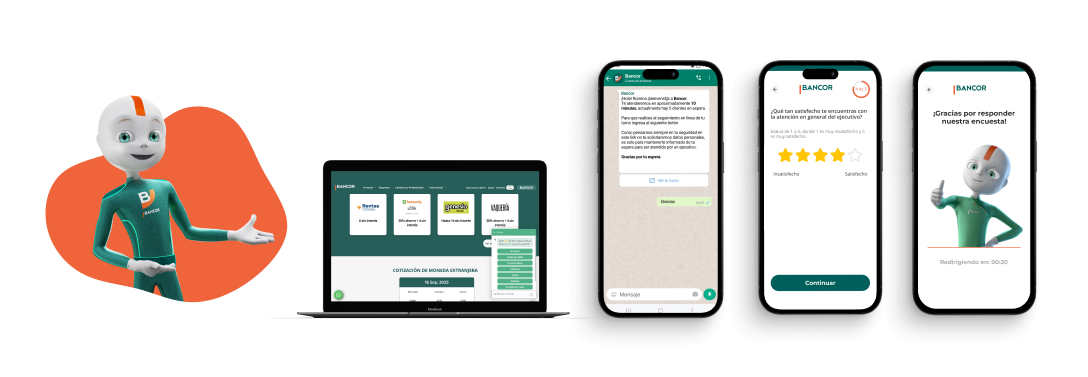

A self-service chatbot was developed with an advanced security layer based on OTP (One-Time Password), ensuring user validation for each operation. The solution automated inquiries about cards, statements, transactions, and frequent requests, as well as critical processes like travel notifications and purchase authorizations. Thanks to the “EO – BCR chatbot”, customers can manage their operations immediately and securely, freeing the bank’s team from repetitive tasks.

Incorporating Chatbot with automated processes.

Thanks to self-service available 24/7.

of the bank with the incorporation of the Chatbot.

Discover how to enhance your customers’ digital experience with intelligent chatbots